Humility

As we enter the third year of a world dominated by the evolving COVID-19 pandemic, it’s worth reflecting on what lessons, if any, we have learned from the experience, and whether any such lessons might be applied to the management of our investment portfolios. One year ago, (see “If You Had a Crystal Ball”, Q1 2021) I posed a question: if you knew that early in 2020 the globe would be ravaged by the onset of a pandemic infection causing a major economic collapse, would you have increased portfolio risk in anticipation of the lofty 18.4% return provided by the US stock market for the full year? Most of us would have answered: “certainly not”. 2020 was followed by an even stronger stock market performance in 2021, in which the S&P 500 (bolstered by a booming economy and accommodative monetary policy) returned an extraordinary 28.7%. This banner year for stocks occurred against the backdrop of unprecedented peacetime government debt accumulation, historically high valuations, ever-deepening domestic political fissures, and seemingly endless new COVID variants that have materially altered the ways in which most people live.

Just as this period has amply demonstrated the difficulty in making forecasts, particularly about the future (a wonderful quip variously attributed to Mark Twain, Niels Bohr, and Yogi Berra), it also demonstrated how little we really can know about a rapidly evolving virus. Indeed, the half-life of prevailing wisdom on COVID has generally proved to be quite short, and those who have expressed the greatest certainty on the topic and its implications have often had events expose the limitations of their views.

As a result, my reflection on the lessons to be learned from this period suggests that the primary lessons are the importance of first humility, and second imagination. Humility requires an understanding that in the field of prediction anyone can be wrong. Even informed forecasts will often be wrong, and sometimes almost everyone will be wrong. An important implication for achieving financial goals follows: success in meeting financial objectives must not rely on one’s ability to forecast the economy, earnings, or markets…but rather on creating a plan with risk aligned with the investor’s objectives, timeframe, and personal circumstances.

Secondly, imagination is critical. It is imagination that allows one to envision seemingly improbable outcomes that others often cannot (for example, a global pandemic, and the market reaction to it). These are the outcomes that are most impactful, since their probabilities are not factored into current prices. More on this concept later.

Tactical Portfolio Change

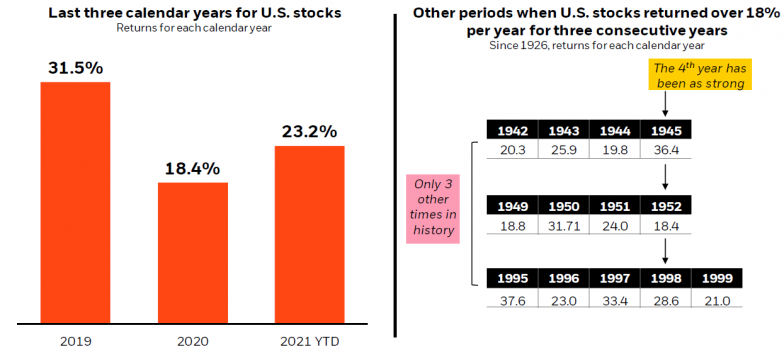

We recently executed a two-part tactical change across our portfolios. The first leg of the change involved a shift of part of our exposure to large US growth stocks into large US value stocks. As the name implies, growth stocks are so named because they have exhibited (and are expected to continue to exhibit) earnings and revenue growth higher than the market average. Think Apple, Tesla, Amazon, etc. Growth stocks typically are more expensive than value stocks, since investors are willing to pay up for the expectation of higher stock prices in the future. Value stocks tend to be mature companies that are cheaper and are viewed as being more stable, both factors which offset the expectation of slower growth. Examples are Proctor & Gamble, GE, JP Morgan, and Exxon Mobil. The reason for our shift into value is that, after many years of outperformance, growth stocks are now far more expensive than value stocks relative to historical averages. Graph 1 shows the price/earnings (P/E) differential, and the average margin by which value has subsequently outperformed when such a valuation differential has existed. Moreover, we feel that value stocks may have less downside volatility in an environment of rising interest rates and/or a stock market correction.

Graph 1

Source: Blackrock, Morningstar

The second leg of our tactical change involved the purchase of a newly approved “Alternatives” fund. Alternative is industry lingo for an asset that that offers positive return potential, while being less correlated to the major asset classes (stocks and bonds). The idea is that alternative assets will buffer downside portfolio volatility, while contributing to positive returns. It’s important to contrast uncorrelated assets with negatively correlated assets, as the latter simply (to a great extent) zig when other assets zag, with the result being the diminution of returns in exchange for downside minimization. While Wall Street has long marketed many investment vehicles as alternatives, we have struggled to find any that truly offer the requisite attributes: low correlation, positive return potential evidenced by a successful track record, reasonable cost, and liquidity. We recently found such a fund which passed our due diligence review, and have added it to our portfolios. The purchase was funded by selling high grade bond positions. Please contact us if you’d like more detail on the newly approved strategy.

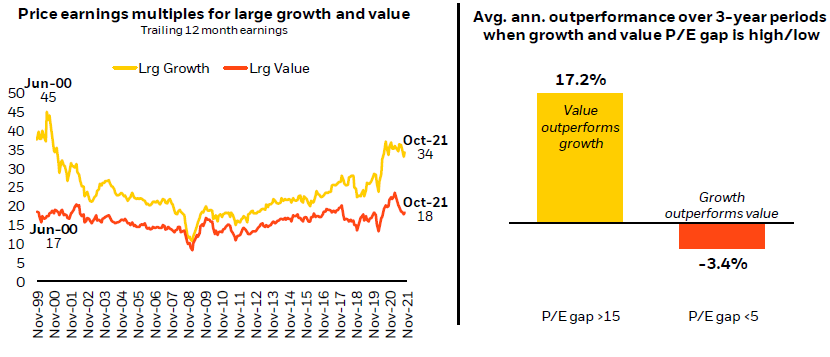

Since our growth to value switch was done on a dollar for dollar basis, the overall equity allocation in our portfolios remains unchanged. We continue to be positioned with a slight underweight equity exposure overall, which we think strikes a good balance between the risk posed by markets at current expensive valuations, and the opportunity posed by the strong economy, boosted by ample liquidity available at low interest rates. Despite how dangerous the stock market might appear at these valuations and after such a run of strong performance, we are mindful that it’s very difficult to accurately pick a top, and trends tend to continue longer than many “experts” think. Graph 2 illustrates historical precedent for three strong years in the US stock market being followed by a very strong fourth year.

Graph 2

Source: Blackrock, Morningstar

Imagination

By imagination, I refer to the importance of thinking differently. To be good investors requires that we critically examine the prevailing wisdom in the markets, and have the courage and discipline to reach different conclusions at times, particularly when we see a strong consensus. It is all too easy to assume that what the market believes is most likely to happen will in fact occur. And while the consensus sometimes proves right, it often doesn’t….and when it doesn’t, we tend to see dramatic market moves as prices adjust to revised expectations. Imagination allows us to ask “what if” questions and challenge conventional thinking. A healthy skepticism combined with rigorous analysis lies at the heart of all of our investment decisions.

Thank you for your trust, and the entire SFA team wishes you a wonderful and successful 2022.

David E. Marion

Partner

(505) 501-6201

To Top

To Top