Imagine that you had a crystal ball, which granted you the ability to see major future events before they occurred. And imagine that you peered into that ball just over a year ago, and as a result you received what might qualify as the biggest single piece of insider information in history: that the world would be ravaged by a global pandemic, resulting in one of the swiftest and deepest global recessions in history and a resultant collapse in corporate earnings. Given that information, what changes to your investment portfolio might you have made at that time? Would you have aggressively increased exposure to risky assets such as stocks? Would you have contemplated that in 2020, the US stock market would return a lofty 18.7% (almost twice the historical annual average!), as the S&P 500 did? Probably not. However, with the benefit of hindsight, we now know that increasing exposure to stocks would have been the correct decision.

Of course no such crystal balls exist, and despite what Wall Street firms would have you believe, even the most experienced financial professionals are poor predictors of future events. As this example illustrates, even if we knew future events with certainty, it would be exceedingly difficult to accurately predict how markets would react to these events. The “Brexit” vote and Donald Trump’s 2016 election are other recent examples of major events and market reactions that were widely unanticipated.

This quick contemplative exercise is an important one: we should be realistic about our ability to forecast the future, an awareness that has profound implications for managing investment portfolio risk.

The rapid global spread of the COVID-19 virus early last year elicited an equally rapid policy response. In addition to business closures and travel restriction, most governments initiated a combination of fiscal and monetary support intended to mitigate the pain of the shutdown and support an economic recovery. Debt-financed fiscal “stimulus” was targeted to offset lost business and household income, while monetary policy was employed to provide ample low-cost access to financing. The latter included central banks both lowering short term interest rates (to 0% in the US), as well as an acceleration of “Quantitative Easing” (Q/E), which means central banks buying bonds with newly created money, thereby artificially subsidizing financing costs by driving down long-term interest rates. While the ultimate costs of these policies (potentially including asset bubbles and subsequent crashes, and future debt crises) are likely to be significant, these costs are deferred to a later date. Meanwhile these initiatives have provided some support to the economic recovery and inarguably have represented powerful tailwinds to financial markets.

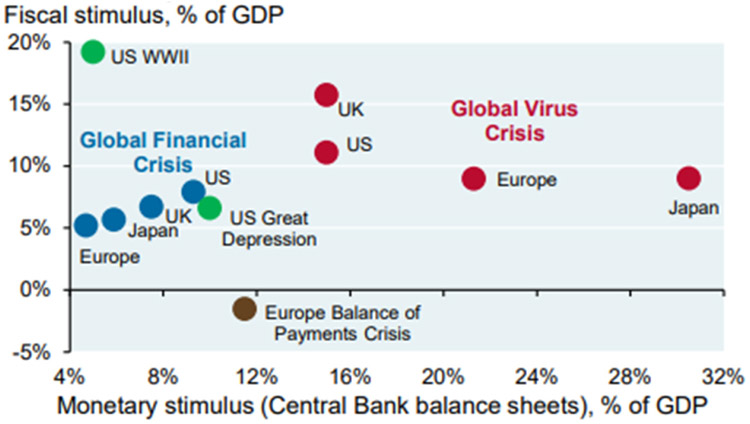

That these fiscal and monetary tools were so quickly deployed is largely due to the experience policymakers gained during and after the ‘08/’09 Financial Crisis, when these tools were aggressively employed to great effect…at least on the stock market. Graph 1 shows the extent of fiscal and monetary support across several regions and events, and highlights how the COVID policy response dwarfs that of previous crises. Seen in this light, the extraordinary stock market rally of the last 10 months is perhaps unsurprising – an excess of low-cost money has to be deployed somewhere, and with interest rates near all-time lows, there is a shortage of attractive alternatives.

Graph 1 – Source: JPM, OMB, CBs, St Louis Fed

There Are Always Reasons to be Bullish or Bearish

Well, almost always – I might argue that late ’99 and mid ’07 were exceptions. In any case, it is important to avoid the tendency to be overly confident in one’s ability to predict market direction, and to ignore the advice of those who can’t envision that their view might be wrong. Markets are complex and are influenced by many factors, and irrational trends can persist for long periods. A sound investment strategy must be able to survive downturns and periods when fundamental investment principles seem not to apply.

Even now, it is not difficult to construct rational bullish or bearish investment theses.

A stock market bull might point to the powerful upward trend in stocks, the broadening global and domestic economic recovery, the likelihood of greater fiscal support with the Democratic party controlling the Executive and Legislative branches, the expanding distribution of COVID vaccines, negative equity supply in the US as companies stay private or buy back stock, unattractive bond yields, and of course the tidal wave of low-cost liquidity provided by current monetary policy.

A bear could convincingly point to stock valuations near all-time highs, the likelihood of higher taxes and a less business-friendly regulatory environment under the Biden administration, the staggering growth in US deficits and national debt, company earnings and economic activity well below pre-COVID peaks, our country’s deep social and political divide, and the potential for further COVID infection waves.

Most of these issues are real, and they matter….at least to some extent. Nevertheless, markets tend to focus on a few such issues at a given time, while ignoring others that might seem equally valid. Right now, as in the years following the Financial Crisis, markets seem primarily focused on fiscal and monetary policy support.

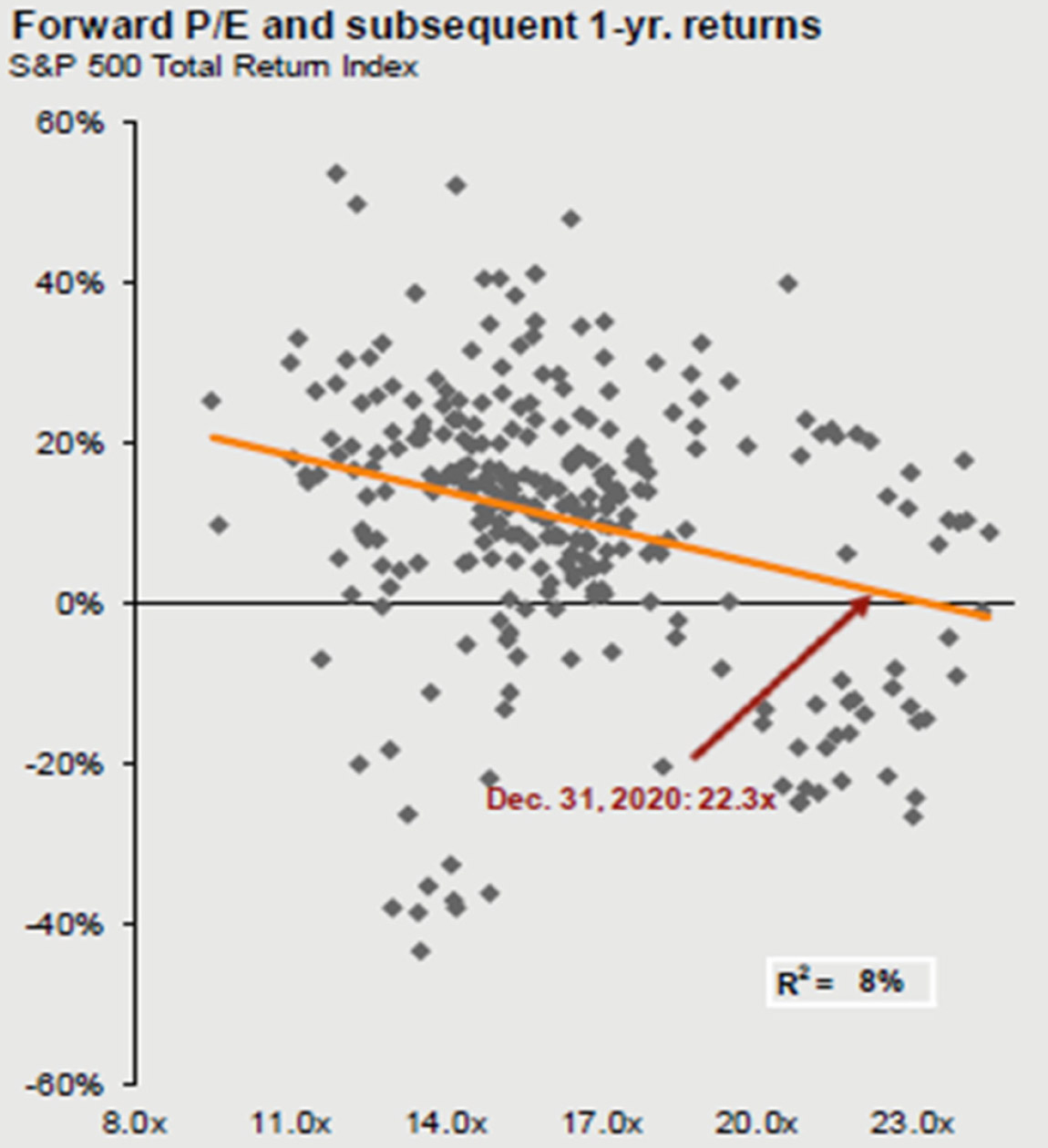

Whereas stock market valuations tend to offer considerable predictive value over intermediate/long-term timeframes (see our Q3 2020 commentary Waves and Tides), they have little predictive value over short timeframes. Graph 2 underscores this point, showing a very low historical correlation between the S&P 500 Price/Earnings ratio and subsequent 1 year returns. For this reason, despite current extended stock valuations, the current market rally could persist for some time.

Graph 2 – Source: JPM, FactSet, S&P, Thomson Reuters

I have listed some of the known reasons that might support a positive or negative view on market direction. Often the biggest drivers of market direction are unknown factors, which are therefore not easily predicted. Such occurrences often have outsized market impact for precisely that reason: their possibility is not reflected in market prices. The 2020 pandemic is a perfect example. Such surprises could be either positive or negative. The COVID virus might be contained much more rapidly than expected, leading to economic and earnings growth well in excess of forecasts. Or perhaps Russia or China, encouraged by our domestic strife, might test our resolve with a (further) invasion of Ukraine, or of Taiwan, respectively.

As we have often counseled, an investment strategy that will allow you to realize your financial objectives does not hinge upon superior predictive powers, but rather upon implementing and sticking with a diversified, low cost portfolio with risk aligned with your personal circumstances. Our crystal ball is calibrated to do that effectively, so let’s review your overall plan annually.

Thank you for your trust and support, and the SFA team wishes you and your loved ones a safe, happy, and marginally less interesting 2021.

To Top

To Top