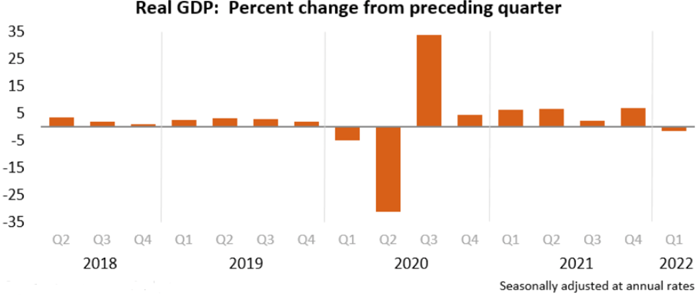

Downside market volatility returned with a vengeance in the first half of 2022. Inflation accelerated as the economy softened, raising the specter of a return of the stagflation of the 1970s. The most recent CPI showed headline inflation 9.1% higher than a year ago, while “core” inflation (excluding volatile food and energy prices) rose 5.9%. This sustained surge in price levels occurred while the US economy shrank at an annualized rate of 1.6% in the first quarter of 2022.

Graph 1

Source: US BEA

This unwelcome combination has placed the Federal Reserve governors in a pickle as they decide monetary policy going forward: if they tighten policy (by raising interest rates) too aggressively, they risk tipping an already softening economy into recession. Conversely, if they keep policy too easy (by keeping rates low) they risk getting further behind inflation and inflation expectations, increasing the risk of even more aggressive tightening in the future, and perhaps a deeper recession. After being very slow to react to persistent high inflation amidst the post-COVID shutdown economic recovery, this year the Fed changed course and belatedly began to hike rates, with increasing aggressiveness as inflation has shown no signs of abating.

Fears about of slowing growth and sustained high inflation have rattled markets, causing the broad US stock market to fall into bear market territory, with the S&P 500 dropping by over 20% from its January 3 record high. Compounding the pain for investors, high grade bonds (traditionally a hedge against stock market declines) have suffered their worst start to a year in history; the Bloomberg Barclays US Aggregate

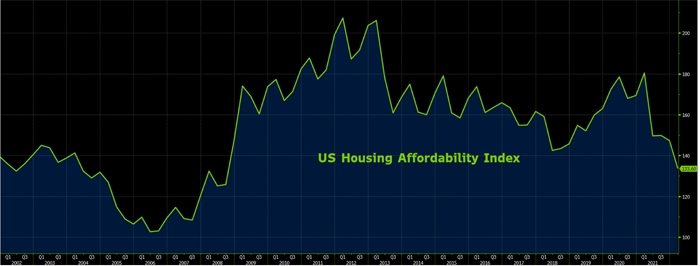

Index lost over 10% in the first half of 2022, as higher interest rates pushed bond prices down. The US economy, which had run red-hot for two years after the initial COVID shutdown, has shown mixed signals. The labor market remains exceptionally strong, with unemployment at 3.6% and robust new job growth. However, the housing market has shown signs of rapid cooling, as the dual impact of 20%+ annual price increases and a doubling of mortgage rates in a year have reduced affordability to the lowest level since before the Great Financial Crisis of 2008/2009. See Graph 2, which shows a 20-year history of US housing affordability.

Graph 2

Source: BBG, NAR

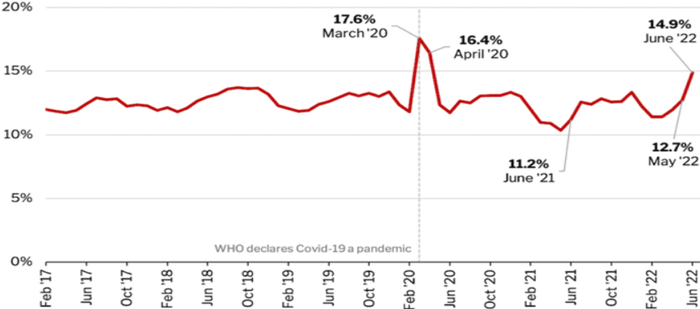

As Graph 3 illustrates, these pressures have contributed to a rapid rise in home sale cancellations, as almost 15% of new purchase agreements fell through in June. As the housing market represents roughly 18% of the US economy, a sustained lull in the sector could be a deciding factor in tipping the economy into recession.

Graph 3

Source: Redfin

Financial media pundits and Wall Street strategists spend a great deal of time talking about recession forecasts. Yet such forecasts and predictions are generally of little value. Recessions (defined as two consecutive quarters of negative economic growth) are identified after the fact: increasing certainty about the occurrence of a recession comes at the price of being late and is therefore unactionable from the investor’s perspective. Markets are forward looking, and major market moves (such as the recent stock market correction) occur because investors in aggregate are pricing in increasing recession probabilities. In other words, recession fears are already reflected in today’s stock prices and, if those fears become overblown or prices adjust more than the economic outlook can justify, that may lead to opportunities to add equity risk at more attractive levels.

To put some context around current market valuations, the S&P 500 now trades at a price of 19.5x earnings of the previous 12 months. While this is still well above the long-term average of 16.8x, it is far below the 32x level of early 2021. Lower prices and higher earnings have made stocks cheaper, and therefore less risky. High yield bonds now yield close to 9% (close to the long-term average), after hitting 3.4% last year. In other words, the painful price corrections of 2022 have created more attractive investment opportunities.

As famed investor Warren Buffet allegedly once said: “Be fearful when others are greedy, and greedy when others are fearful”. Remember that corrections create opportunities. If one is willing to ignore headlines and to selectively add risk at lower prices, as well as to trim risk after extended rallies, that can lead to favorable investment results and long-term objectives being met.

This year the Federal Reserve has increased the Fed Funds policy interest rate from near 0% to 1.75% and is expected to increase the rate to 3.5% by the end of 2022. While that might tip the economy into recession (if it is not already there), it also might lead to a rally if markets perceive that the Fed has slain the inflation beast. Our current portfolio positioning includes a modest underweight position in stocks and credit, which we are reviewing with an openness to add risk if prices decline further.

Thank you for your trust, and please contact a SFA team member with questions, or to review the appropriateness of your current investment strategy.

The information contained within this letter is strictly for information purposes and should in no way be construed as investment advice or recommendations. Investment recommendations are made only to clients of Santa Fe Advisors, LLC on an individual basis. The views expressed in this document are those of Santa Fe Advisors as of the date of this letter. Our views are subject to change at any time based upon market or other conditions and Santa Fe Advisors has no responsibility to update such views. This material is being furnished on a confidential basis, is not intended for public use or distribution, and is not to be reproduced or distributed to others without the prior consent of Santa Fe Advisors.

To Top

To Top