Just as market strategists held a strong view at the beginning of 2023 that the year would bring an economic recession, 2024 began with a consensus that the economy would avoid recession this year. The belief was that the Federal Reserve Bank would successfully engineer an economic “soft landing” by adjusting interest rates so that inflation would continue to fall, while avoiding a downturn by lowering interest rates throughout the year.

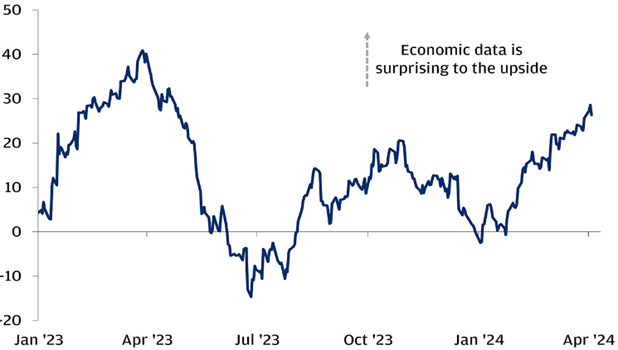

At this juncture, consensus expectations seem to have been half right: while progress on inflation has stalled, the US and global economies have been quite resilient in the face of higher interest rates, with growth and economic results that have handily exceeded expectations. Graph 1 shows the Citi Global Economic Surprise Index, which shows that far more data releases have beaten forecasts than missed. As a result, equity markets have responded favorably, with large US stocks posting a 10.6% first quarter return; global markets also posted solid results with developed market stocks returning 5.8%, and emerging market stocks returning 2.4%.

Graph 1

Source: JPM, Citi, BBG

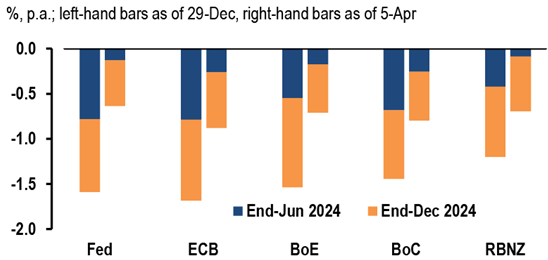

In contrast to strong stock performance in 2024, high quality bonds have done less well, losing just under 1% in the first quarter. This weak performance is due to markets having rapidly revised expectations of 2024 interest rate cuts because of surprising economic strength and stalled inflation progress. At the start of this year, markets expected the Fed to cut interest rates by 1.6% in 2024; now expectations are for just .4% in cuts (and there might be no 2024 rate cuts at all). In other words, year-end 2024 interest rate expectations are 1.2% higher than they were just three months ago – a material repricing of expectations equivalent to a 1.2% rise in rates, which led to a rapid decline in bond prices (when interest rates rise, bond prices fall). Graph 2 shows that expectations of rate cuts from the Fed and other central banks have rapidly declined in recent weeks. Whereas a strong economy generally provides a tailwind for stocks, it represents a headwind for bonds, since economic strength usually brings higher interest rates.

Graph 2

Source: JPM

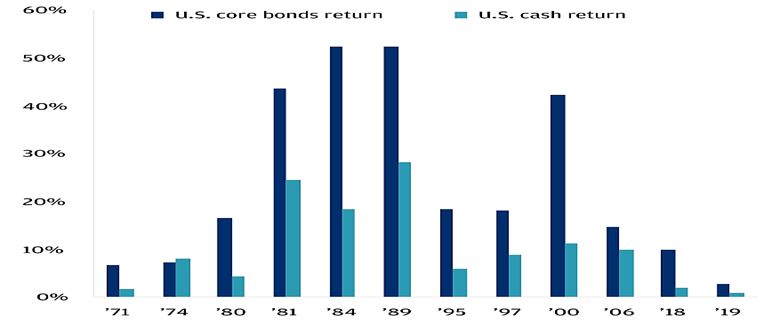

However, now that expectations for interest rate cuts are less aggressive, and bond yields have risen, high quality bonds are now more poised to provide attractive returns going forward. This touches on a theme that we have frequently noted in our monthly strategy meetings: although higher short term interest rates make holding cash now much more appealing than in recent years (when cash paid close to 0%), seeking safety in cash (even at these higher yields) is generally a bad idea for the long term. Investors holding cash generally earn returns far less than those provided by stocks and bonds, both of which benefit when rates do begin to fall.

Graph 3 shows the total return of high-quality bonds and cash in each of the last dozen rate cycles, from the final rate hike to the final rate cut.

Graph 3

Source: JPM, BBG, Haver Analytics, Ibbotson

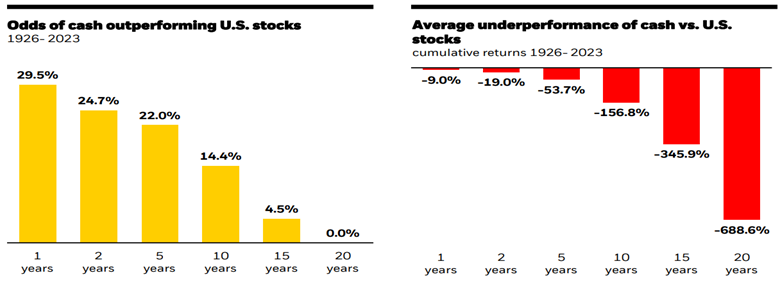

Graph 4 shows the odds of cash outperforming stocks over various periods going back to 1926, and the magnitude of the stock market performance advantage.

Graph 4

Source: BlackRock, Morningstar

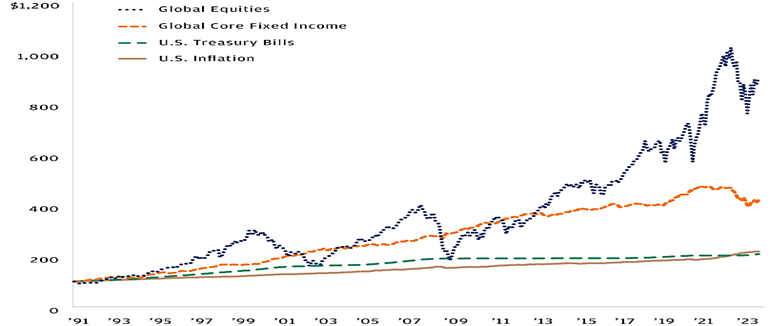

Finally, Graph 5 shows the cumulative return over the last 32 years of global stocks, global bonds, and cash (the performance advantage of US stocks and bonds relative to cash has been even more pronounced). We can see that cash has only kept pace with inflation over this period, resulting in no increase in purchasing power for cash investors. The lesson is clear: keep enough cash for a few months of expenses, but otherwise stay invested throughout market cycles.

Graph 5

Source: JPM, BBG

We recently began implementing a modest tactical change in our portfolios, in the form of a small increase in small and mid-sized US company stocks. The primary reason for this is that over the past several years the US stock market has dramatically outperformed foreign markets, leading to the US market value being a much higher percentage of the global stock market than it was several years ago. We generally want to keep our allocations broadly in line with global market weightings, so we felt that a modest increase to US equities was appropriate.

Thank you for your trust, and please contact a SFA team member with any questions, or to review the alignment of your portfolio with your personal circumstances.

The information contained within this letter is strictly for information purposes and should in no way be construed as investment advice or recommendations. Investment recommendations are made only to clients of Santa Fe Advisors, LLC on an individual basis. The views expressed in this document are those of Santa Fe Advisors as of the date of this letter. Our views are subject to change at any time based upon market or other conditions and Santa Fe Advisors has no responsibility to update such views. This material is being furnished on a confidential basis, is not intended for public use or distribution, and is not to be reproduced or distributed to others without the prior consent of Santa Fe Advisors.

To Top

To Top