Volatility returned to financial markets last month in the wake of the second and third largest bank failures in US history (Silicon Valley Bank [SIVB], and Signature Bank [SBNY]), followed by UBS’s purchase of Credit Suisse (one of the 30 global banks deemed systemically important) to save the latter from imminent collapse. These concerning events led to much talk in the financial media about a systemic banking crisis: in other words another financial crisis with parallels to 2008.

In short, this is not 2008.

Several factors led to the swift collapse of the US banks, including a number of regulatory failures (which we discussed in March at our last monthly strategy meeting). Ultimately, these banks failed because of age-old reasons for bank failure: deposit flight, asset/liability mismatches which led to losses as interest rates rose, and the inability of the banks to raise capital under stressed circumstances. While Credit Suisse had been hemorrhaging clients and was also unable to raise capital, they had suffered from a litany of woes for a long time.

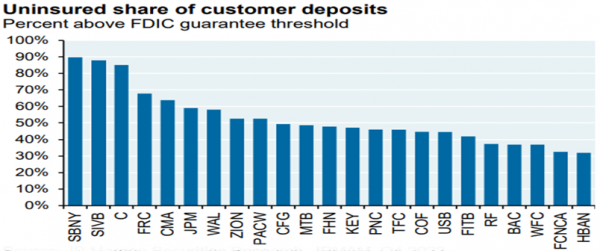

Ultimately, a bank exists and thrives based on confidence, above all else. When confidence in a bank goes, clients and deposits flee, the bank can’t raise capital, and it fails. A major reason that SIVB and SBNY failed is that they were extremely aggressive in growing their deposit base, and most of their deposits were above the FDIC insurance limit of $250k per account. See Graph 1. Logically, this made them vulnerable, as uninsured depositors tend to quickly pull their money at the first sight of trouble. These banks created the conditions for a classic bank run, which inevitably occurred.

Graph 1

Source: JPM

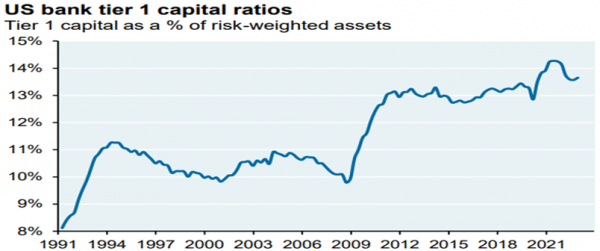

While these shocks were concerning, for several reasons investors should take comfort that the banking system (both US and global) is far stronger than it was preceding the Great Financial Crisis (GFC) of 2008. Regulators have learned to quickly employ tools with which to quickly provide needed liquidity, and banks have far more capital to absorb losses than they did in the years preceding the GFC. See Graph 2. With this in mind, major market corrections based on overblown fears of a banking collapse (broad bank stock indices recently declined over 30%) should be viewed as buying opportunities.

Graph 2

Source: JPM, FDIC, BBG

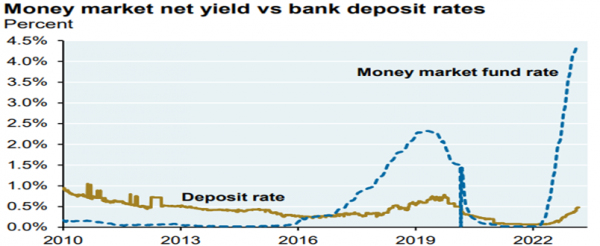

Graph 3 shows the rapid recent increase in money market fund yields since the Fed began raising interest rates over a year ago; it also shows that banks have been much slower to raise the rates they pay for deposits. Of course, banks want to save money by paying as little as they can. While this is rational behavior, it also makes banks vulnerable to deposit flight (if higher rates are available elsewhere), particularly banks like SIVB and SBNY that grew aggressively, and had such a large percentage of deposits that were uninsured. While the rapid rise in yields therefore increased the risk of deposit flight from vulnerable banks, it also meant that high grade bond yields were far higher than a year ago. As we have repeatedly noted (see our Q1 commentary “Now There Is An Alternative”), higher yields meant that high grade bonds were likely to produce positive returns during times of stress, in contrast to 2022 when both stocks and bonds declined together. In fact, high grade bonds have returned 2.1% since the SIVB bank failure, and 3.6% YTD.

Graph 3

Source: JPM, BBG

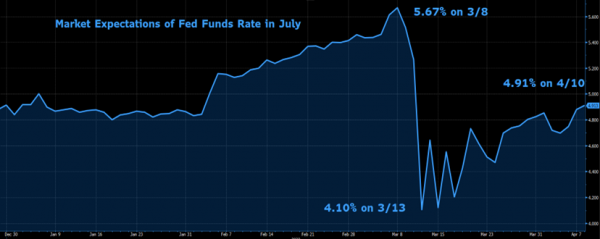

We often articulate the need to think differently from the crowd, particularly when sentiment leans to either positive or negative extremes. In recent communications, amidst tremendous negativity in the financial press, we argued that investors should try to envision a benign outcome emerging from the current environment. One possible outcome we suggested is that the banking stress might cause the Fed to slow (or cease) interest rate increases, a development that would likely be well received by markets, were it to occur. In that scenario, particularly against a backdrop of declining inflation and a resilient economy, both stocks and bonds might enjoy a relief rally. In fact, that is exactly what has occurred. Graph 4 shows market expectations of the Fed Funds policy rate this coming July. Within days of the SIVB failure, market expectations went from expecting a 1% more in rate hikes by July, to actually expecting an interest rate cut! (since then, expectations have adjusted and now no further changes are anticipated by July). Underscoring the point, as of this writing US stocks have returned 8.3% in 2023, and 7.3% since SIVB failed a month ago.

Graph 4

Source: BBG

None of this means that the short-term outlook is rosy. The stress and intensified regulatory scrutiny that banks now face are almost certain to lead to tighter lending standards and a reduction in credit extension. These likely developments would represent a headwind to the economy, and materially increase the probability and depth of an economic contraction in 2023. These are typical cyclical realities; a banking crisis they are not.

To summarize, ignore the crowd, ignore the doomsayers and keep calm and carry on.

Please contact a SFA team member with any questions, or to review the appropriateness of your current investment plan.

The information contained within this letter is strictly for information purposes and should in no way be construed as investment advice or recommendations. Investment recommendations are made only to clients of Santa Fe Advisors, LLC on an individual basis. The views expressed in this document are those of Santa Fe Advisors as of the date of this letter. Our views are subject to change at any time based upon market or other conditions and Santa Fe Advisors has no responsibility to update such views. This material is being furnished on a confidential basis, is not intended for public use or distribution, and is not to be reproduced or distributed to others without the prior consent of Santa Fe Advisors.

To Top

To Top